How Is Money Made in Forex?

Money can be made in Forex trading when the currency being bought increases in value or the currency being sold decreases in value. Whether you buy a specific currency pair because you expect positive data for one currency or sell another currency to express a negative view, the outcome is the same. Forex trading is a zero-sum game, meaning that when one party makes a profit, the other party experiences a loss.

For instance, if you buy the AUD/USD at 0.8500 and sell it at 0.8700, you have gained 200 pips. However, the person who sold to you at 0.8500 experiences an opportunity loss of the same 200 pips. Although they may have made a profit if they bought the AUD at a lower price, the fact remains that they missed out on the potential gain if they had held the position.

Sometimes, the seller may have been closing a hedging position. If they held a debt or were short on an asset denominated in euros and bought euros as a hedge, they may close the currency position once the asset position is closed. Hedging positions are typically held for longer durations and in larger amounts compared to retail Forex trades.

On the other hand, if the currency you sold continues to rise in value after you sold it, you experience an opportunity loss. Trading coaches advise against dwelling on missed opportunities and emphasize the importance of focusing on the present.

When you sell a currency pair first and buy it back later, you are technically shorting the first currency and buying the second currency. For example, selling USD/CAD at 1.0950 and buying it back at 1.0900 results in a gain of 50 pips from selling US dollars and buying Canadian dollars.

In Forex trading, there is no stigma attached to short selling like there is in other asset classes. Short selling in equities is often associated with negative connotations, but in Forex, it is simply a matter of buying one currency while selling another. Forex trading does not carry the same negative reputation as shorting equities or commodities.

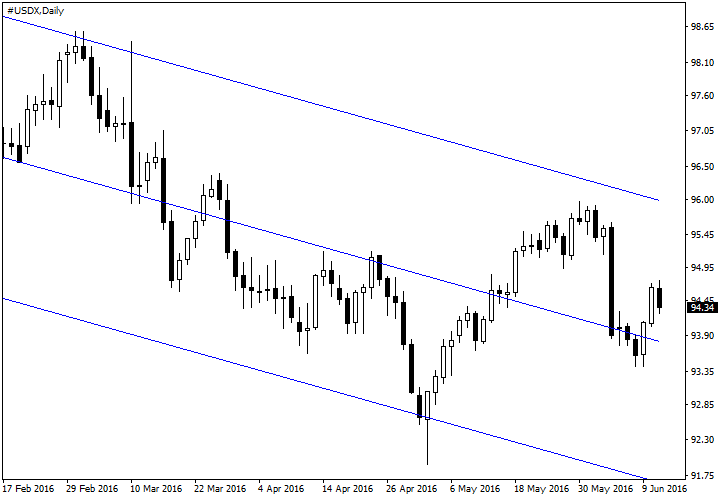

While there may be an anti-USD bias in Forex trading, it is not always advisable to buy other currencies and sell USD. The USD can rally in certain situations. To gauge overall USD sentiment, it is helpful to look at the dollar index (USDX).

In summary, Forex trading offers the opportunity to make money by buying currencies that increase in value or selling currencies that decrease in value. Short selling in Forex does not carry the same negative connotations as in other asset classes. Proper analysis and understanding of market dynamics are crucial for success in Forex trading.

The Forex market often exhibits identifiable trends for currencies, accompanied by reasons why traders favor or devalue certain currencies. For instance, the Australian dollar (AUD) has maintained a yield advantage over other developed countries’ 10-year notes for a decade. This has created an upward bias for the AUD against lower-yielding currencies, such as the Japanese yen and the USD. However, it’s important to note that adverse Australian economic data or efforts by the central bank or treasury to devalue the AUD can still cause abrupt declines.

The British pound (GBP) also has its own distinct characteristics, particularly in relation to the USD. When the prospects for the UK are more positive than those of other countries, the pound tends to strengthen. However, London traders who specialize in the pound are also known for aggressively selling sterling when the outlook becomes gloomy. This dynamic makes upward movements challenging and corrections and downward movements particularly severe.

These examples highlight the challenging nature of Forex trading due to the suddenness of market changes. As a result, traders often engage in short-term trading that lasts only a few hours, despite the potential for longer-term trends in the Forex market.